In trying to achieve positive change for the environment, the greatest obstacles are the established paradigms/models of how people believe things work.

An example is Acid Rain legislation in the early 1990's, where the economic models used by Industry forecasted the doubling of electricity costs if this legislation was enacted. As history has shown, these views were flat wrong -- just as paradigms on many environmental issues such as Global Warming are wrong today.

But its just not Industry putting up the roadblocks. Many of the paradigms held by environmental Interests also result in creating major obstacles.

We are working to create models based on sound-science, sound-engineering, sound-economics, and plain common sense. If one looks hard enough, innovative cost effective approaches to environmental issues can almost always be found.

Value Chain of Growing Energy Crops on Mined Land:

Carbon Sequestration:

A paradigm/model widely held within Climate Change and Renewable Energy Circles (e.g., Scientists, Policymakers) is that energy crops would primarily be grown on traditional farm lands. Since soil science is very clear that: (1) soils have a finite capacity to hold carbon and (2) most traditional farming lands are already near or at a carbon saturation level -- energy crops have not been considered a meaningful tool in CO2 sequestration.

However, if this paradigm is expanded to using degraded or marginal lands such as closed mining sites, the potential of energy crops to create significant levels of permanent carbon sinks can dramatically change.

In the Southern U.S., pre-mined lands were most likely in native forest for hundreds/thousands of years. As such, these sites' soils were probably at carbon saturation. After mining however, empirical research is clear that post-mined lands often have little soil carbon.

Thus, any incremental build-up of carbon from post-mined sites (starting from a low percentage close to zero) to a carbon saturation level (present before mining) would be creating a permanent carbon sink. This concept of "incremental build-up" of carbon levels on mined lands is illustrated in the yellow bar of the graph below.

Carbon Saturation Levels of Pre and Post Mined Soils

Soil research performed by the U.S. Department of Energy's Oak Ridge National Laboratory (ORNL) at our mined site provides empirical data for this argument. In 2.5 years after energy crop tree establishment, soil carbon levels had increased 200% from the pre-existing site conditions (last mined over 60 years ago).

Soil Carbon Percentages Found Before

& 2.5 Years After Tree Planting

Although market establishment for commodity trading of CO2 credits is evolving (e.g., Chicago Board of Exchange), this is of little current value to most Farmers trying to get projects in-the-ground right now.

| However, numerous companies throughout the U.S. are implementing voluntary CO2 Reduction Programs where the "value" of CO2 Credits are currently between $2 (low) and $5 (high) per metric ton of CO2. |

Thus, a potential strategy for Farmers to turn the "CO2 externality" into cash would be to:

Get Outside Verification of a Project's CO2 Sequestration.

Identify a Company Participating in a Voluntary Program.

Strike a Deal: $2 to $5 per Ton of CO2 Sequestered.

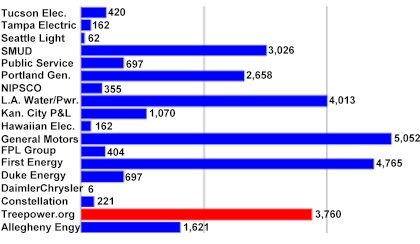

To illustrate the above points, the CO2 sequestered just at our one project (~130 acres) exceeds or is comparable to voluntary efforts of some major U.S. corporations.

Comparing Treepower.org Project to Major Corporations

(Metric Tons of CO2 Sequestered)

Mining Reclamation:

Field research conducted by the University of Florida and ORNL is showing that carbon sequestration efforts on mined lands in central Florida can have a dramatic "value added" impact in building soil quality -- potentially turning thousands of acres in historically viewed "wastelands" into productive land use.

In a "plantation approach" to mining reclamation, between 2,000 and 4,000 trees are planted per acre. As a result of this high density tree planting, tremendous volumes of organics (~50% carbon) are being introduced into soils via tree root systems -- initiating a catalytic effect to build/repair mined soils:

Under this plantation approach to reclamation, fast growing trees are used as "Bridge Crops. After soils have been repaired/rebuilt, the mined site could:

Continue in Forestry Ag use (energy crops, mulch, etc.), or

Be Re-planted for Other Ag Use (e.g., bard), or

Re-planted to Create Native Forests (recreation, water

quality & management, wildlife habitats, etc.)

Field results from our site are showing the impact of this soil building in re-creating a diverse and functioning ecosystem. For example, ~30 species of native plants and diverse populations of birds have now returned to the site. Additional Externality benefits such as water quality are also being achieved through the re-establishment of native flora (e.g., ferns which uptake heavy metals) and improved hydrology (e.g., un-compacting of heavy soils).

| In establishing our energy crop tree plantation, costs of ~$1,250 per acre were incurred. While this cost is approximately double the costs (~$600 an acre) by Farmers establishing tree plantations on non-mined land in the Region -- it is also 40% less than costs (~$2,000 per acre) using traditional methods to reclaim phosphate mined lands.

|

Establishment Cost Per Acre

The above points lead to an interesting concept. Florida, like most States, levies a tax on mined products (e.g., phosphate, coal, etc.) to fund land restoration. Each State's Department of Environmental Protection administers this fund and sets Reclamation Standards.

"What IF" Farmers growing crops on mined lands qualified for say, a $600 subsidy from the Mining Reclamation Fund? It's important to note that this concept would not represent a "new tax" but a reallocation of existing tax monies for reclamation.

In our opinion, such a subsidy could be a win/win. First, a $600 subsidy would lower the establishment cost per acre on phosphate mined lands equal to the costs on non-mined lands. Second, at $600 per acre, this would be $1,400 lower than the costs currently paid to reclaim land -- allowing more lands to be reclaimed through the Mining Severance Tax Fund.

Thus, if farming reclamation achieves equal or greater environmental reclamation benefits and at lower costs than traditional methods -- such an approach just makes common sense.

A strategy to turn the "reclamation externality" into cash is for Farmers to work with their State's Department of Environmental Projection to "qualify" farming as an allowable Reclamation methodology. Possible work tasks to achieve this objective could include:

Farming/State EPA Pilot Demonstrations.

Developing Environmental Standards for Farming

Reclamation.

Cogongrass Control: Another environmental issue with post-mining is weed invasion and dominance on sites. On phosphate mined lands in central Florida, cogongrass (an invasive species originating from Southeast Asia) is a very serious environmental concern. According to the USDA, cogongrass is the 3rd most invasive noxious weed in the world and is rapidly spreading throughout the Southeast U.S.

| Also, according to the U.S. Department of the Interior, cogongrass may be costing ~$500 million per year in control, and crop and fire damage.

|

The key word in existing USDA funded programs available to Farmers in combating cogongrass is "control" and not elimination -- as this complex weed can not be effectively killed even with repeated applications of herbicides (only controlled).

Established Weed Science is clear that cogongrass is shade intolerant. Field research from our tree farm is supporting this opinion, as cogongrass is disappearing through the formation of energy crop tree canopy that heavily shades the forest understory floor.

Thus, a potential strategy of turning this externality into cash is for Farmers to communicate with the USDA -- qualifying tree plantation farming for funding under existing USDA programs for cogongrass weed control.

Urban Sprawl: Based on U.S. Census data, 1,600 square miles of rural land was converted to commercial and residential development by urban sprawl in Florida during the past 20 years. While our research has been unable to find an "exact estimate", it is believed that Florida is losing in the range of 80 to 100 square miles per year to urban sprawl. One of the fastest growing areas of urban sprawl in the entire U.S. is the I-4 corridor from Tampa to Orlando.

We believe that concerns over urban sprawl in central Florida emphasize the need to truly reclaim land from clay settling areas (CSAs) which represent approximately 40% of all phosphate mined lands -- or ~220 square miles originally in wooded uplands and wetlands. As a measure of magnitude, CSAs in central Florida represent a land mass about one-third the size of Lake Okeechobee.

Renewable Energy Marketing: Among many environmental groups, biomass energy is not considered "green", creating a significant obstacle to marketing efforts. The problem is the use of a "micro-view" paradigm, where projects are viewed on a "stand alone" basis. Under this view, since biomass energy involves combustion and does emit air pollutants, this option is often excluded as a true green energy source compared to zero emission wind or solar.

| The exclusion of biomass energy projects from Green Marketing Programs have a severe economic impact, recognizing that the Median Price Premium for Green Power is 2.5¢/kWh (which equates to ~$22.50 per green ton of biomass fuel).

|

In reality however, no power plant "stands alone". Green energy generation, like all dispatchable resources (coal, natural gas, oil, nuclear) is placed on a large regional Power Grid. Using this "macro-view", the environmental benefits of Renewables result from the fossil fuels that the Green Energy will actually displace on the Grid -- where not all Renewables displace the same fossil fuel.

For example, the U.S. Department of Energy is clear that the operating characteristics of typical solar photovoltaic resources result in the displacement of natural gas peaking load generation (e.g., combustion turbines). Alternatively, when biomass fuel is co-fired in coal power plants, obviously coal use is decreased.

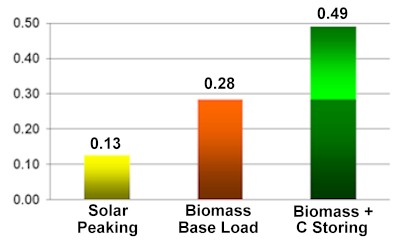

In using this "macro-view" paradigm, the results can be surprising to environmental groups not having technical expertise in how the power industry actually works (e.g., dispatching power plants on the Power Grid):

Carbon Reductions of Renewable Energy Options

(Carbon ton/MWh)

Understanding the above chart is straight forward. The value of solar photovoltaics is the CO2 emissions avoided from running a typical natural gas combustion turbine unit. For both biomass options, the value is avoided CO2 emissions from a typical pulverized coal unit -- with the energy crop option reflecting the additional below ground carbon sequestration benefit.

Recognizing that approximately 90% of all air pollution (e.g., NOx, CO2, Smog, Mercury) comes from coal-fired generation, the need to displace the "right" fossil fuel is critical if environmental objectives such as meaningful reductions in U.S. green-house gases are to be achieved.

Clearly, the ability to market biomass as a renewable energy option is made difficult if environmentally conscious consumers don't believe it's "green". Our Strategy to change this widely held view is through educational outreach by:

Developing data from highly respected sources such as

EPRI, Universities, and U.S. Department of Energy Labs

(e.g., engineering, carbon sequestration).

To communicate this data in developing Green Energy

Accreditation Programs that will include biomass

energy (e.g., the Florida Chapter of the Sierra Club).

Developing "customer demand" for biomass energy

especially from Companies that have a stake in issues

like farming, rural economic development, and mining.

In developing customer demand for renewable energy from energy crops it is critical to think "outside the traditional box" with regard to aspects like Climate Change. For example, opposition to mining expansion is increasing significantly over the issue of land reclamation (especially concerns over the impact on water quality with mining). It is very much in the "core interests" of mining companies to support initiatives that could dramatically increase the reclamation/restoration of mined lands. Also, agriculture companies may very well find their positions with regard to imports, exports, international tariffs and subsidies could be enhanced by adopting "green actions".

Renewable Energy Cash Incentives: There are two Federal cash incentives available for electricity generation from energy crop fuel (closed loop biomass) that is placed on the Power Grid:

The Renewable Energy Production Incentive (REPI)

available to public electric utilities who do not pay

federal income taxes (Municipalities, Cities, Co-ops).

The Section 45 Tax Credit for Electricity Companies

that do pay federal income taxes.

While both Federal Incentives have a stipulated value currently at 1.76 ¢/kWh, the Section 45 Tax Credit's actual cash value is higher. Since the Tax Credit results in a dollar for dollar reduction in income taxes, the cash value (called a revenue requirement benefit) is 1.76 divided by (1 minus the tax rate) -- or 2.76 ¢/kWh.

Cash Value of REPI & Section 45 Tax Credit

(cents/kWh)

By making a couple of assumptions on the efficiency of a power plant that uses energy crops (a heat rate of 10,000) and the heat content of the biomass fuel (~4,500 Btus per pound) -- we can calculate what these Federal subsidies equate to in reducing the electric utility's cost of fuel.

Cash Value of REPI & Section 45 Tax Credit

(dollars/green ton of fuel)

Putting It All Together: As previously discussed, if energy crops are used in biomass co-firing, clearly coal is displaced. If we assume a cost of coal at $2 per MMBtu, the Power Provider would be indifferent to burning coal versus paying $18.00 per green ton for energy crop fuel (with energy crop fuel having a Btu content of 4,500 Btus per pound).

Thus, incorporating this value of "avoided coal cost" with the other available incentives previously discussed (e.g., Federal Incentives, CO2 Credits, typical Green Energy Premiums charged customers) -- the total pool of value added benefits for Electricity Companies to use energy crop fuel is shown below:

Summary of Value Added Cash Incentives

(dollars/green ton of fuel)

|